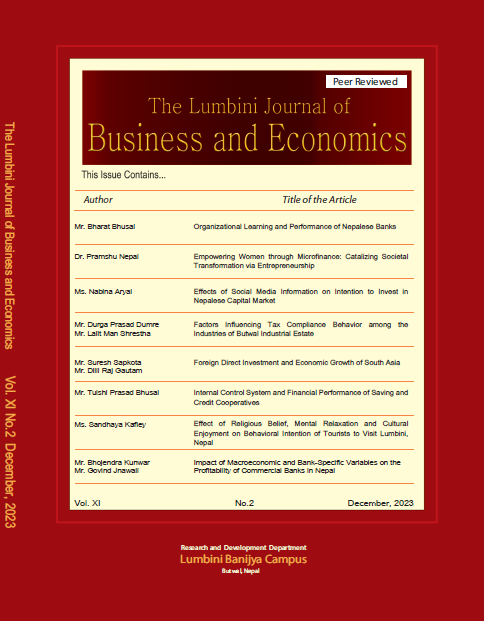

Internal Control System and Financial Performance of Saving and Credit Cooperatives

DOI:

https://doi.org/10.3126/ljbe.v11i2.64722Keywords:

SACCOs, COSO Framework, Internal Control System, Financial PerformanceAbstract

The study aims to assess the effect of the internal control system on the perceived financial performance of saving and credit cooperatives. Internal controls were measured using four elements (i.e. control environment, risk assessment, control activities, and information and communication) as prescribed by the Tedway Committee of Sponsoring Organizations (COSO) framework. Perceived financial performance has been measured through the increase in ROA, ROE, deposit and lending, liquidity and EPS. A descriptive and casual comparative research design was adopted to describe the relationship and effect between the elements of internal control system and financial performance. Out of 86 saving and credit cooperatives registered under the legislative area of Butwal Sub-Metropolitan city, only 38 has been considered as sample. A structured questionnaire on 5 point likert scale ranging from strongly disagree to strongly agree has been adopted. The findings of the study has revealed that the SACCOs (Shaving and Credit Co-operative enjoy a sound financial performance partly because of implementing and maintaining effective internal control system.